nassau county tax rate calculator

To calculate the sales tax amount for all other values use our sales tax calculator above. Claim the Exemptions to Which Youre Entitled.

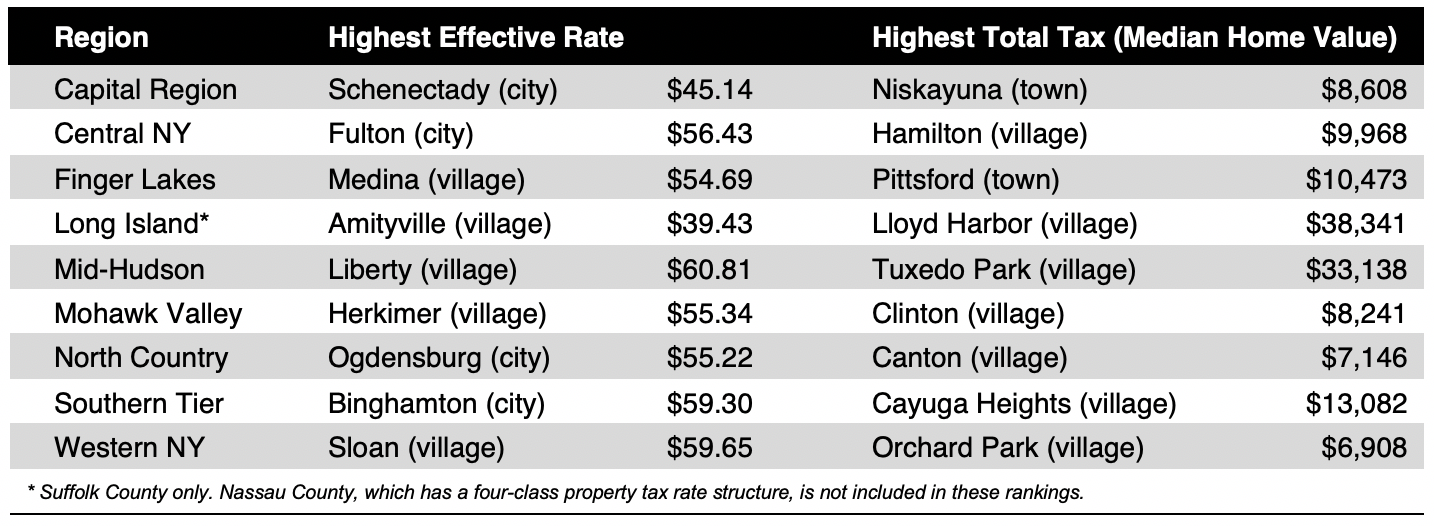

New York Property Tax Calculator 2020 Empire Center For Public Policy

Look up 2022 sales tax rates for Nassau County New York.

. Nassau County Tax Lien Sale. STIPULATION OF SETTLEMENT CALCULATOR. Nassau County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Nassau County totaling 1.

How to Challenge Your Assessment. You can find more tax rates and allowances for Nassau County and Florida in the 2022 Florida Tax Tables. The December 2020 total local sales tax rate was also 8625.

Multiply the estimated market value by the level of assessmentî which is 6 Tax Class 1 or 45 all other classes. Ad Enter Your Tax Information. Use Our Free Powerful Software to Estimate Your Taxes.

74 rows Nassau County New York Sales Tax Rate 2022 Up to 8875 Nassau County Has No. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Rules of Procedure PDF Information for Property Owners.

The average cumulative sales tax rate between all of them is 7. Please contact Freedom Land Title for an accurate title invoice. Nassau County uses a simple formula to calculate your property taxes.

Discover Helpful Information And Resources On Taxes From AARP. Thus its mainly just budgeting first establishing a yearly expenditure amount. A propertys annual property tax bill is calculated by multiplying the taxable value with the tax rate.

Nassau County Florida Sales Tax Calculator 7 Average Sales Tax For Nassau County Florida Summary Nassau County is located in Florida and contains around 5 cities towns and other locations. All fees are subject to change. Nassau County NY Sales Tax Rate The current total local sales tax rate in Nassau County NY is 8625.

Even so the average effective property tax rate in Suffolk County is 237 far above both state and national averages. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 863 in Nassau County New York. Tax rates provided by Avalara are updated monthly.

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund. Skip to main content Sales877-780-4848 Support Sign in Solutions Products Resources Partners About Blog Search SearchWhen autocomplete results are available use up and down arrows to review and enter to select. Most Populous Locations in Nassau County New York Valley Stream.

NASSAU COUNTY ASSESSMENT REVIEW COMMISSION. Then they calculate the tax rates needed to. As for zip codes there are around 7 of them.

See What Credits and Deductions Apply to You. Assessment Challenge Forms Instructions. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County.

Estimate the propertys market value. As calculated a composite tax rate times the market value total will show the countys entire tax burden and include individual taxpayers share. Learn how Avalara can help your business with sales tax compliance today.

179 of home value Yearly median tax in Nassau County The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. You can find more tax rates and allowances for Nassau County and New York in the 2022 New York Tax Tables. Standardize Taxability on Sales and Purchase Transactions.

Our Nassau County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States. Ad Integrates Directly w Industry-Leading ERPs. Nassau County Sales Tax Rates for 2022 Nassau County in New York has a tax rate of 863 for 2022 this includes the New York Sales Tax Rate of 4 and Local Sales Tax Rates in Nassau County totaling 463.

NY State Mortgage Tax Rates - Freedom Land Title Agency New York State Mortgage Tax Rates County Name County Rate Table For mortgages less than 10000 the mortgage tax is 30 less than the regular applicable rate. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Choose a tax districtcity from the drop-down box selections include the taxing district number the name of the districtcity and the millage rate used for calculation Enter a market value in the space provided.

Now one pays tax on hisher net taxable income. Nassau County New York Property Tax Go To Different County 871100 Avg. A full list of these can be found below.

In dollar terms Westchester County has some of the highest property taxes not only in the state of New York but in the entire country. Assessed Value AV x Tax Rate Dollar Amount of Taxes. Ad Solutions to help your business manage the sales tax compliance journey.

Do Your Due Diligence Or Let Us Do it For You What is the formula to calculate tax. All numbers are rounded in the normal fashion.

Naspad All Nassau Data Genesis Computer Consultants

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Property Taxes In Nassau County Suffolk County

Which 3 Row Suvs Offer Captain S Chairs News Cars Com

Nassau County Property Tax Reduction Tax Grievance Long Island

How To Calculate Sales Tax For Your Online Store

Naspad All Nassau Data Genesis Computer Consultants

Compare Your Property Taxes Empire Center For Public Policy

Naspad All Nassau Data Genesis Computer Consultants

Robert Morris Architect Nassau Bay House Clear Lake Texas C Photo By Cyndy Allard Special Design And Concr Custom Built Homes Houston Real Estate House Styles

2022 Best Places To Buy A House In Nassau County Ny Niche

New York Property Tax Calculator Smartasset

Naspad All Nassau Data Genesis Computer Consultants

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Ny Property Tax Search And Records Propertyshark

Property Taxes In Nassau County Suffolk County

Why Do Banks Keep Going Bankrupt Kirby R Cundiff Bankruptcy Managing Your Money Filing Bankruptcy